Page 14 - Demo

P. 14

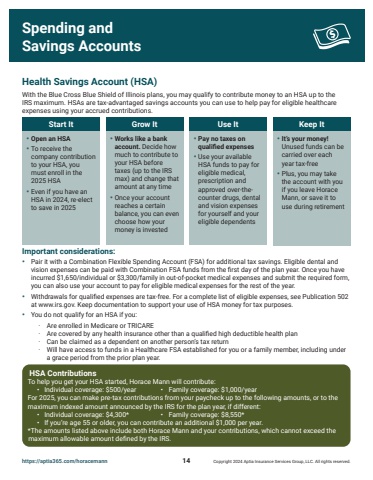

https://aptia365.com/horacemann 14 Copyright 2024 Aptia Insurance Services Group, LLC. All rights reserved.Health Savings Account (HSA)With the Blue Cross Blue Shield of Illinois plans, you may qualify to contribute money to an HSA up to the IRS maximum. HSAs are tax-advantaged savings accounts you can use to help pay for eligible healthcare expenses using your accrued contributions.%u2022 Open an HSA%u2022 To receive the company contribution to your HSA, you must enroll in the 2025 HSA%u2022 Even if you have an HSA in 2024, re-elect to save in 2025%u2022 Works like a bank account. Decide how much to contribute to your HSA before taxes (up to the IRS max) and change that amount at any time%u2022 Once your account reaches a certain balance, you can even choose how your money is invested%u2022 Pay no taxes on qualified expenses%u2022 Use your available HSA funds to pay for eligible medical, prescription and approved over-thecounter drugs, dental and vision expenses for yourself and your eligible dependents%u2022 It%u2019s your money! Unused funds can be carried over each year tax-free%u2022 Plus, you may take the account with you if you leave Horace Mann, or save it to use during retirementStart It Grow It Use It Keep ItImportant considerations:%u2022 Pair it with a Combination Flexible Spending Account (FSA) for additional tax savings. Eligible dental and vision expenses can be paid with Combination FSA funds from the first day of the plan year. Once you have incurred $1,650/individual or $3,300/family in out-of-pocket medical expenses and submit the required form, you can also use your account to pay for eligible medical expenses for the rest of the year.%u2022 Withdrawals for qualified expenses are tax-free. For a complete list of eligible expenses, see Publication 502 at www.irs.gov. Keep documentation to support your use of HSA money for tax purposes.%u2022 You do not qualify for an HSA if you:%u00b7 Are enrolled in Medicare or TRICARE%u00b7 Are covered by any health insurance other than a qualified high deductible health plan%u00b7 Can be claimed as a dependent on another person%u2019s tax return%u00b7 Will have access to funds in a Healthcare FSA established for you or a family member, including under a grace period from the prior plan year.HSA ContributionsTo help you get your HSA started, Horace Mann will contribute:%u2022 Individual coverage: $500/year %u2022 Family coverage: $1,000/yearFor 2025, you can make pre-tax contributions from your paycheck up to the following amounts, or to the maximum indexed amount announced by the IRS for the plan year, if different:%u2022 Individual coverage: $4,300* %u2022 Family coverage: $8,550*%u2022 If you%u2019re age 55 or older, you can contribute an additional $1,000 per year.*The amounts listed above include both Horace Mann and your contributions, which cannot exceed the maximum allowable amount defined by the IRS. Spending and Savings Accounts